Original from: Siemens Healthineers

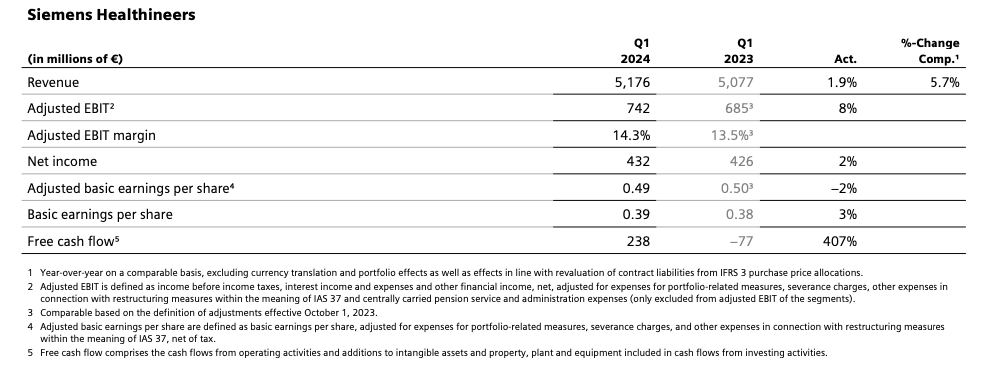

Siemens Healthineers AG today announces its results for the first quarter of fiscal year 2024 ended December 31, 2023.

Q1 Fiscal Year 2024

Īż Very good equipment book-to-bill ratio of 1.14

Īż Strong comparable revenue growth of 7.0% excluding rapid COVID-19 antigen tests; comparable revenue growth of 5.7% including the rapid antigen-test business, which ended in the fourth quarter of fiscal year 2023

Īż Imaging comparable revenue growth of 5.3%; adjusted EBIT margin of 19.1% due to a temporary unfavorable business mix

Īż Diagnostics comparable revenue growth of 1.6% excluding rapid COVID-19 antigen tests; comparable revenue declined by 4.0% including the now-ended rapid antigen-test business; adjusted EBIT margin of 5.1%

Īż Varian sharp comparable revenue growth of 22.3%; adjusted EBIT margin of 15.9%

Īż Advanced Therapies comparable revenue growth of 5.0%; adjusted EBIT margin of 14.3%

Īż Overall adjusted EBIT margin of 14.3% was above prior-year quarter

Īż Adjusted basic earnings per share of Ć0.49

Outlook for Fiscal Year 2024

We confirm our expectation of comparable revenue growth of between 4.5% and 6.5% (between 5.0% and 7.0% excluding revenue from rapid COVID-19 antigen tests) and adjusted basic earnings per share of between Ć2.10 and Ć2.30.

Bernd Montag, CEO of Siemens Healthineers AG:

»We had a good start to the new financial year with broad-based growth. The transformation of our Diagnostics business is showing positive momentum and Varian delivered strong results. In parallel we are focused on our new, ambitious sustainability goals.«

Revenue amounted to just under Ć5.2 billion in the first quarter of fiscal year 2024. Excluding the rapid COVID-19 antigen-test business, which ended in the fourth quarter of fiscal year 2023, comparable revenue rose by 7.0%. Including the rapid antigen-test business, comparable revenue grew by 5.7%. The Varian segment in particular contributed to the strong revenue development, with a sharp rise.

From a geographical perspective, the EMEA region showed significant revenue growth on a comparable basis. Revenue in the China region rose strongly on a comparable basis over the pandemic-weakened prior-year quarter, while the Americas region achieved moderate comparable revenue growth. In the Asia Pacific Japan region, comparable revenue showed a moderate decline due to the now-ended rapid antigen-test business. Excluding rapid antigen tests, the Asia Pacific Japan region also recorded moderate comparable revenue growth.

Equipment order intake in the first quarter again surpassed equipment revenue ©C the equipment book-to-bill ratio was 1.14.

Adjusted EBIT rose by 8% to Ć742 million in the first quarter. This resulted in an adjusted EBIT margin of 14.3%, which was also higher than in the prior-year quarter. Now-ended earnings contributions from the rapid COVID-19 antigen-test business were more than compensated for by contributions from good revenue development.

Net income rose by 2% compared with the prior-year period to Ć432 million. The tax rate was 20%, higher than the 14% of the prior-year quarter, which had benefited from the release of a tax provision in the mid-double-digit millions of euros.

Adjusted basic earnings per share of Ć0.49 were roughly on a par with the prior-year period (Ć0.50). The increase in earnings contributions from operating activities ©C despite the now-ended rapid COVID-19 antigen-test business (contribution in the prior-year quarter: Ć0.03) ©C was roughly offset by higher financing costs and the higher tax rate than in the prior-year quarter.

Free cash flow was Ć238 million, up from the prior-year quarter.

Outlook

For fiscal year 2024, we continue to expect comparable revenue growth of between 4.5% and 6.5% over fiscal year 2023. Excluding revenue from rapid COVID-19 antigen tests, this corresponds to comparable revenue growth of between 5.0% and 7.0%.

The expectation for adjusted basic earnings per share remains unchanged at between Ć2.10 and Ć2.30.

The outlook is based on several assumptions. This includes the expectation that the current macroeconomic environment, including the interest rate level, will remain largely unchanged. Furthermore, from todayĪ»s point of view we expect that the market in China will pick up by the end of the second quarter of fiscal year 2024. In addition, the outlook is based on assumptions about exchange rate developments. Assumptions for the negative currency effect on adjusted basic earnings per share have increased to around Ć0.10, up Ć0.02 from the assumptions underlying the outlook in the 2023 Annual Report. This is mainly due to the weakening of the U.S. dollar. Furthermore, this outlook excludes potential portfolio measures. In addition, the outlook is based on the assumption that developments related to the war in Ukraine and conflicts in the Middle East will not have a material impact on our business activities. The outlook is based on the number of shares outstanding at the end of fiscal year 2023. This outlook also excludes charges from legal, tax and regulatory issues and framework conditions.

Source: Siemens Healthineers lays solid foundation for fiscal year 2024 with strong growth in first quarter