Original from: Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global leader in life science research and clinical diagnostics products, today announced financial results for the fourth quarter and full year ended December 31, 2023.

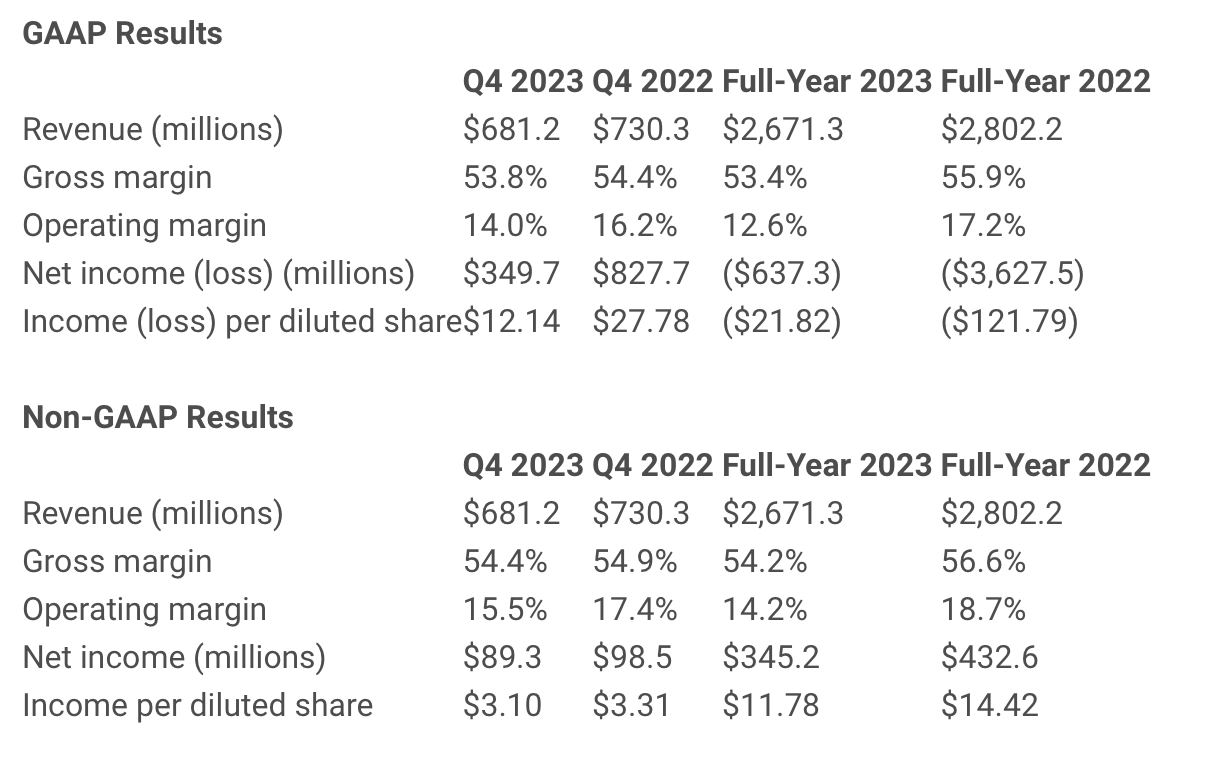

Fourth-quarter 2023 total net sales were $681.2 million, a decrease of 6.7 percent compared to $730.3 million reported for the fourth quarter of 2022. On a currency-neutral basis, quarterly sales decreased 7.7 percent compared to the same period in 2022. COVID-related sales were approximately $0.3 million in the fourth quarter of 2023 versus approximately $13.4 million in the year ago period. Excluding COVID-related sales, revenue decreased 6.0 percent on a currency-neutral basis.

Life Science segment net sales for the fourth quarter were $291.1 million, a decline of 19.1 percent compared to the same period in 2022. On a currency-neutral basis, Life Science segment sales decreased by 19.9 percent compared to the same quarter in 2022. Excluding COVID-related sales, Life Science revenue decreased 17.0 percent. The decline was broad-based, primarily due to lower sales of ddPCR, qPCR, and Western blotting products.

Clinical Diagnostics segment net sales for the fourth quarter were $389.0 million, an increase of 5.3 percent compared to the same period in 2022. On a currency-neutral basis, net sales increased 4.2 percent versus the same quarter last year. Excluding COVID-related sales, Clinical Diagnostics revenue increased 4.3 percent year over year, on a currency-neutral basis, driven by strong demand for diabetes and quality control related products.

Fourth-quarter gross margin was 53.8 percent compared to 54.4 percent during the fourth quarter of 2022.

Income from operations during the fourth quarter of 2023 was $95.3 million versus $118.7 million during the same quarter last year.

Net income for the fourth quarter of 2023 was $349.7 million, or $12.14 per share, on a diluted basis, versus net income of $827.7 million, or $27.78 per share, on a diluted basis, during the same period in 2022. Net income amounts for the fourth quarter of 2023 and 2022 were primarily impacted by the recognition of changes in the fair market value of equity securities related to the holdings of the company¡¯s investment in Sartorius AG.

The effective tax rate for the fourth quarter of 2023 was 18.4 percent, compared to 24.2 percent for the same period in 2022. The tax rates for both periods were driven by the unrealized gain in equity securities. The lower rate in 2023 was primarily driven by a geographical mix of earnings.

¡°The ongoing weakness in biopharma markets continued to impact our fourth-quarter 2023 results, which were largely in line with expectations,¡± said Norman Schwartz, Bio-Rad¡¯s President and Chief Executive Officer. ¡°Shifting focus to 2024, our full-year outlook reflects ongoing execution of our corporate transformation initiatives, effective expense management, and a cautiously optimistic view of a gradual biopharma sector recovery in the second half of the year,¡± Mr. Schwartz continued. ¡°We also recognize the efforts of our global employees, whose ongoing dedication and commitment to our customers¡¯ success helped us navigate the challenges of 2023.¡±

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading ¡°Use of Non-GAAP and Currency-Neutral Reporting.¡± A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 54.4 percent for the fourth quarter of 2023 compared to 54.9 percent during the fourth quarter of 2022.

Non-GAAP income from operations during the fourth quarter of 2023 was $105.2 million versus $127.0 million during the comparable prior-year period.

Non-GAAP net income for the fourth quarter of 2023 was $89.3 million, or $3.10 per share, on a diluted basis, compared to $98.5 million, or $3.31 per share, on a diluted basis, during the same period in 2022.

The non-GAAP effective tax rate for the fourth quarter of 2023 was 22.4 percent, compared to 28.1 percent for the same period in 2022. The lower rate in 2023 was primarily driven by a geographical mix of earnings and resolution of certain tax positions.

Financial Results Highlights

Full-Year 2023 Results

On a reported basis, net sales for the full year of 2023 decreased 4.7 percent to $2,671.3 million compared to $2,802.2 million for the prior year. On a currency-neutral basis, net sales decreased 4.1 percent.

COVID-related sales for the full year were approximately $4 million, compared to $109 million in the year-ago period. Excluding COVID-related sales, full-year 2023 revenue decreased 0.4 percent year-over-year on a currency-neutral basis.

Full-year 2023 reported net sales for the Life Science segment were $1,178.4 million, a decrease of 12.0 percent compared to the prior year on a currency-neutral basis. Excluding COVID-related sales, Life Science revenue declined 4.9 percent on a currency-neutral basis in 2023 versus 2022, primarily due to lower sales of process chromatography, qPCR, and Western blotting products.

Full-year 2023 reported net sales for the Clinical Diagnostics segment were $1,489.3 million, an increase of 3.2 percent compared to the prior year on a currency-neutral basis. When excluding COVID-related sales, full-year Clinical Diagnostics revenue grew 3.4 percent compared to 2022 on a currency-neutral basis, and was driven by diabetes, quality control, and blood typing products, partially offset by a decline in infectious disease products.

Full-year 2023 gross margin was 53.4 percent, compared to 55.9 percent in 2022.

Full-year 2023 income from operations was $337.8 million versus $482.6 million in 2022.

Net loss for full-year 2023 was $637.3 million, or $21.82 net loss per share, on a fully diluted basis, compared to a net loss of $3,627.5 million, or $121.79 net loss per share, in 2022. Net loss amounts for full-year 2023 and 2022 were primarily impacted by the recognition of changes in the fair market value of equity securities related to the holdings of the company¡¯s investment in Sartorius AG.

The effective tax rate for the full year of 2023 was 25.0 percent compared to 22.9 percent in 2022. The higher rate in 2023 was primarily driven by unrealized loss in equity securities and geographic mix of earnings.

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading ¡°Use of Non-GAAP and Currency-Neutral Reporting.¡± A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 54.2 percent for full-year 2023 compared to 56.6 percent for full-year 2022.

Non-GAAP income from operations for the full year of 2023 was $378.9 million versus $524.0 million for the full year of 2022.

Non-GAAP net income for 2023 was $345.2 million, or $11.78 per share, compared to $432.6 million, or $14.42 per share in 2022.

The non-GAAP effective tax rate for the full year of 2023 was 22.3 percent compared to 22.0 percent in 2022.

Full-Year 2023 Highlights:

¡¤ Full-year 2023 reported net sales of $2,671.3 million compared to $2,802.2 million for the full year of 2022.

¡¤ Excluding COVID-related sales, full-year 2023 revenue decreased 0.4 percent year-over-year on a currency-neutral basis.

¡¤ Full-year 2023 reported net loss of $637.3 million, or $21.82 net loss per share, on a fully diluted basis, compared to a net loss of $3,627.5 million, or $121.79 net loss per share, in 2022.

¡¤ Advanced minimal residual disease (MRD) research through several industry collaborations leveraging Bio-Rad¡¯s QX600™ Droplet Digital™ PCR System (ddPCR).

¡¤ Introduced ddPCR Microsatellite Instability (MSI) Kit and supporting software for oncology applications including cancer tissue and plasma samples.

¡¤ Continued to expand libraries of StarBright™ dyes for flow cytometry in immunology research, as well as a portfolio of antibodies for the development of bioanalytical assays used in preclinical and clinical drug development.

¡¤ Introduced the CFX Opus Deepwell Dx Real-Time PCR System offering researchers efficient, accurate, and precise quantification to help improve in vitro diagnostic assay development and diagnostic testing.

¡¤ Partnered with Element Biosciences to deliver RNA sequencing workflow between Element¡¯s AVITI™ System and Bio-Rad¡¯s SEQuoia™ Express and SEQuoia™ Complete Stranded RNA Library Prep Kits.

¡¤ Launched the PTC Tempo 96 and PTC Tempo Deepwell Thermal Cyclers with enhanced usability to support PCR applications in basic and translational research, process development, and quality control.

¡¤ Introduced IH-500 NEXT™ fully automated blood typing system with enhanced features for routine blood testing.

¡¤ Announced a patent dispute settlement and cross-licensing agreement with QIAGEN N.V. relating to digital PCR technology.

¡¤ Published Bio-Rad¡¯s corporate sustainability report for 2022 and saw meaningful improvements in several sustainability rankings based on increased scores in environmental, labor, human rights, health and safety reporting and policy implementation, as well as higher scores on sustainable procurement metrics, reporting, and work with women and minority-owned businesses.

Full-Year 2024 Financial Outlook

Bio-Rad is providing its financial outlook for the full year 2024. The company currently expects non-GAAP, currency-neutral revenue growth of approximately 1.0 to 2.5 percent and an estimated non-GAAP operating margin of approximately 13.5 to 14.0 percent.

Source: Bio-Rad Reports Fourth-Quarter and Full-Year 2023 Financial Results